Pe ratio formula

Dividing that average number by 365 yields the accounts payable turnover ratio. Market to Book Ratio Formula.

P E Ratios Howthemarketworks

The PEG ratio priceearnings to growth ratio is a valuation metric for determining the relative trade-off between the price of a stock the earnings generated per share and the companys expected growth.

. With the PE ratio at 123 in the first quarter of 2009 much higher than the historical mean of 15 it was the best time in recent history to buy stocks. The ratio is also shown in percentage form as follows. It is calculated as the proportion of the current price per share to the earnings per share.

The PE Ratio helps investors gauge the market value of a share compared to the companys earnings. Accounts Payable AP Turnover Ratio Formula Calculation. According to the NSE website The Nifty 50 PE ratio is calculated as follows.

If earnings per share EPS is lower than zero then that causes the stock to have a negative PE ratio. From April 2021 Consolidated earnings is used to calculate Nifty. This formula is general enough to be applied to any firm even one that is not paying dividends right now.

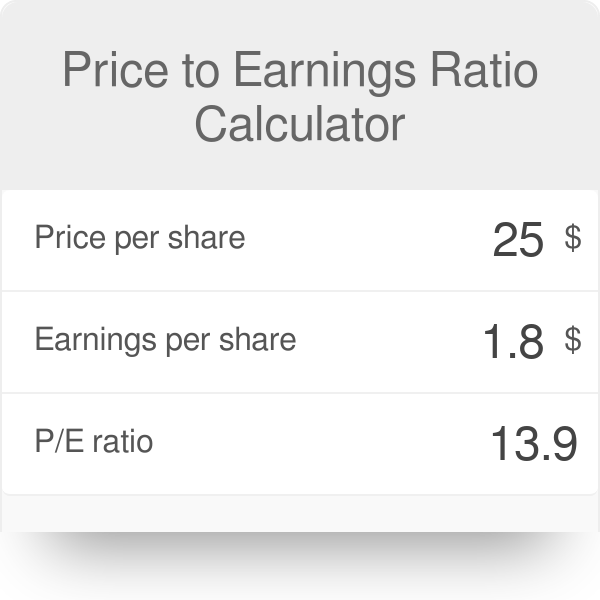

This PE ratio calculator can help you find the price earnings ratio for any shares you are interested in which indicates how many earnings each share within a company can generate. It denotes what the market is willing to pay for a companys profits. Average number of days 365 Accounts Payable Turnover Ratio.

Market Capitalization Net Book Value. Recent speaking engagements include Colorado State University PaleoFX and KetoCon. Thus using just the PE ratio would make high-growth companies appear overvalued relative to others.

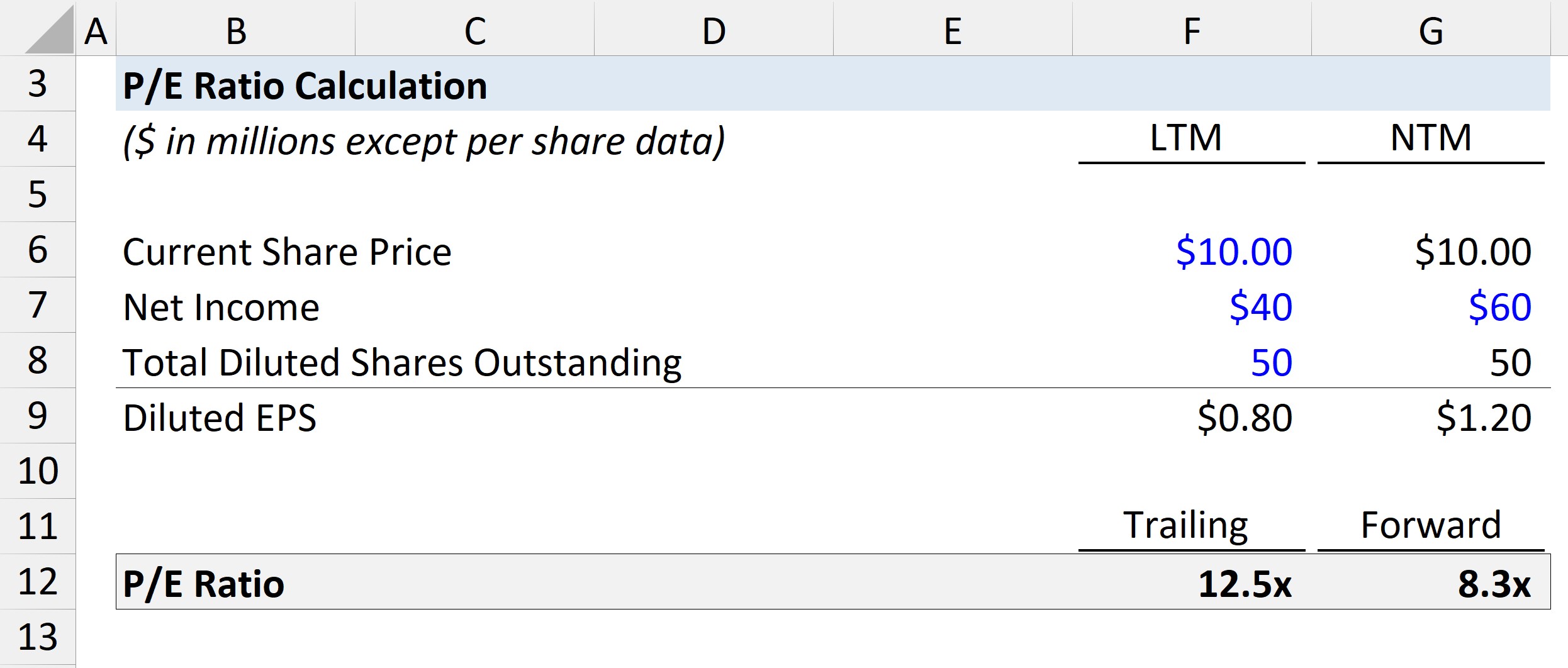

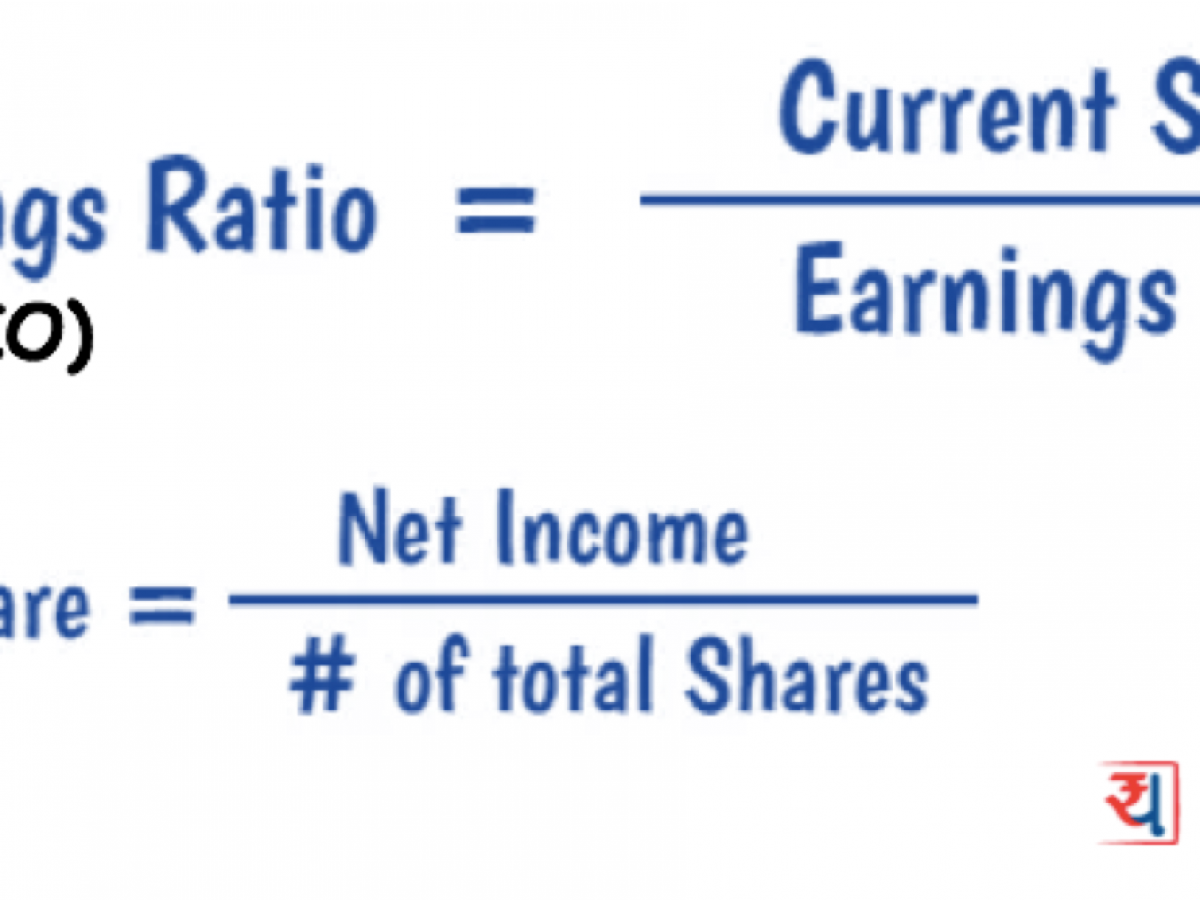

The formula to calculate the PE ratio is as follows. William is the co-author of Carnivore Cooking for Cool Dudes and The PE Diet. Index market capitalization Gross earnings.

Nifty 50 PE Ratio Formula Total Free Float Market Capitalisation of all 50 companies Total Free Float Profit after Tax PAT of last four quarters of all 50 companies. Accounts payable turnover rates are typically calculated by measuring the average number of days that an amount due to a creditor remains unpaid. Growth ratios are indicators of how fast our business is growing.

It depends on many factors. The market to book ratio is calculated by dividing the current closing price of the stock by the most current quarters book value per share. He also does Youtube podcasting fitness modeling and commercials when he is not acting.

Sales growth is a metric that shows the percentage of increase in sales over a specific period. Estimating the PE ratio for a high growth firm in the two-stage model. The PE ratio was high because earnings were depressed.

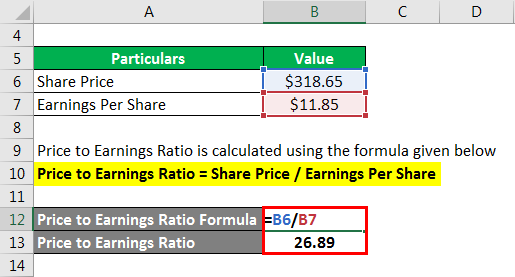

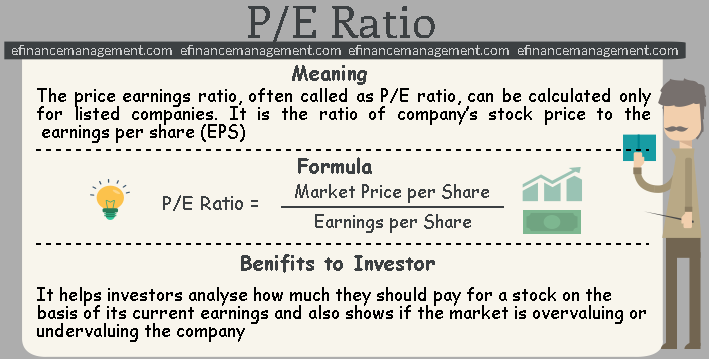

PE Ratio Current Market Price of a Share Earnings per Share Price to Earnings Ratio is one of the most widely-used metrics by analysts and investors across the world. However the diversified portfolio with funds having little to no relationship decreases the absolute risk thereby surging the Sharpe index. 1 of its earnings.

These growth ratios include sales growth income growth and asset growth. It signifies the amount of money an investor is willing to invest in a single share of a company for Re. The CAPE ratio is a valuation measure that uses real earnings per share EPS over a 10-year period to smooth out fluctuations in corporate profits that occur over different periods of.

The formula for the PEG ratio is derived by dividing the stocks price-to-earnings Price-to-earnings The price to earnings PE ratio measures the relative value of the corporate stocks ie whether it is undervalued or overvalued. How Does the PE Ratio Price to Earnings Ratio Work. This ratio is used to denote how much equity investors are paying for each dollar in net assets.

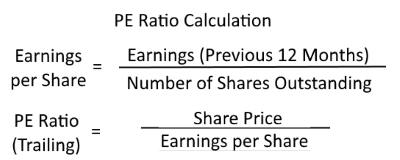

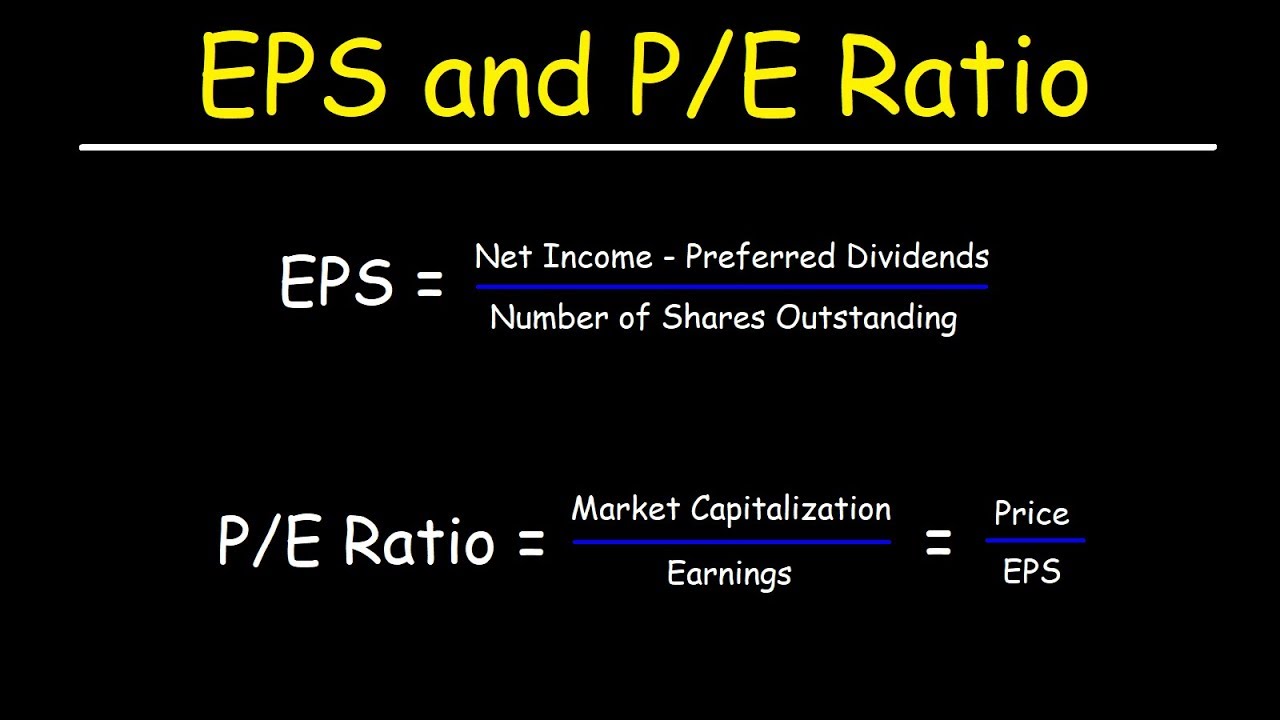

The Market to Book formula is. To arrive at a companys PE ratio youll need to first know its EPS which is calculated by dividing the companys net profits by the number of shares of common stock it. The numerator of the formula ie contribution margin can be calculated using simple contribution margin equation or by preparing a contribution.

On the other hand the Shiller PE ratio was at 133 its lowest level in decades correctly indicating a better time to buy stocks. In general the PE ratio is higher for a company with a higher growth rate. Price-Earnings Ratio - PE Ratio.

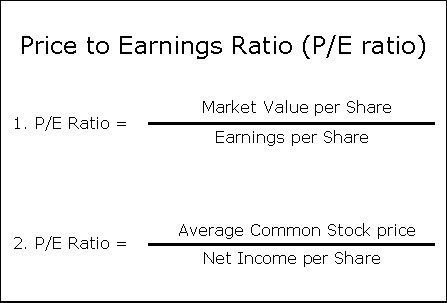

Sharpe ratio definition suggests measuring the risk-adjusted return of the investment portfolioThus it does not independently offer detailed information regarding the funds performance. PE Ratio Market Value Per Share Earning Per Share. The formula for the PE ratio is PE Stock Price Earnings Per Share.

The price-earnings ratio PE ratio is the ratio for valuing a company that measures its current share price relative to its per-share earnings. Index market capitalization of the Index constituents is the sum total of the outstanding equity shares or units considered for index computation multiplied by the last traded price of each index constituent adjusted for factors. However earnings per share is sensitive to various accounting methods so it doesnt always imply that a stock is a bad investment.

Assume that you have been asked to. Below the tool you can find the formula used. He speaks on nutrition fitness and goal setting.

The price-earnings ratio PE Ratio is the relation between a companys share price and earnings per share. In fact the ratio of FCFE to earnings can be substituted for the payout ratio for firms that pay significantly less in dividends than they can afford to. The formula can be written as follows.

P E Ratio Price To Earnings Formula And Calculator Excel Template

What Is The Pe Ratio How To Use The Formula Properly

Price To Earnings Ratio Example Explanation With Excel Template

Price Earnings Ratio Formula Examples And Guide To P E Ratio

P E Ratio Meaning Valuation Formula Calculation Analysis More

Pe Ratio Price To Earnings Definition Formula And More Stock Analysis

P E Ratio Price To Earnings Formula And Calculator Excel Template

Price Earnings Ratio Calculator What Is P E Ratio

What Is A P E Ratio Definition Examples Faq Thestreet

What Is Pe Ratio Trailing P E Vs Forward P E Stock Market Concepts

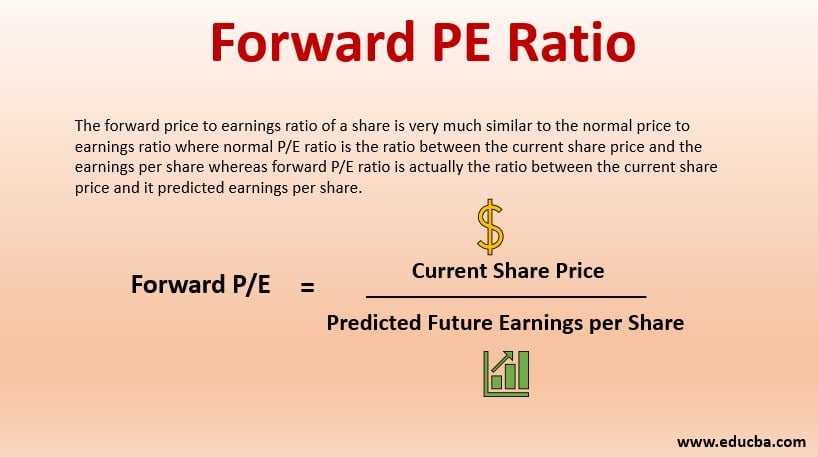

Forward Pe Ratio A Qucik Glance Of Forward Pe Ratio With Example

P E Ratio Definition Formula Examples

Justified P E Ratio Trailing And Forward Formula Excel Template

What Is Pe Ratio Trailing P E Vs Forward P E Stock Market Concepts

What Is A Price Earnings Ratio P E Ratio Formula Examples

Price Earnings Ratio Formula Examples And Guide To P E Ratio

Price To Earnings P E Ratio And Earnings Per Share Eps Explained Youtube